INTERNATIONAL MARKETS:

Understanding Market Differentiation and Entry Strategy.

Let’s explore international market differentiation strategies for expanding businesses and demonstrate how analysis can be conducted with a comparisum example of two well-known retailers.

Introduction

This evaluation will study the differentiation in strategic methods used by businesses seeking to launch an expansion into Vietnamese and Canadian markets. The key differences between each being that one is considered an industrialized nation and the other in the position of developing. The application of statistical evidence to observe each national standing according to ratings systems applied by The World Bank (GNI) and the United Nations (HDI).

Report Assumptions: It must be noted that there is significant importance to access quality data for analysis as this article has, and to consider the fast pace of changing global conditions at the time of any perspective piece when it is being reviewed by the reader. The research also demonstrated that by assuming alternative perspectives such as using a blend of each ratings system or measuring national standings based on other metrics, that this can change the categorization for a nations development status.

The definitions of national development as classed by the various international organizations include:

1. Economic.

National income rating based on financial indicators.

“For analytical purposes, WESP classifies all countries of the world into one of three broad categories: developed economies, economies in transition and developing economies. The composition of these groupings, …, is intended to reflect basic economic country conditions.”

(WESP, 2014)

a) The exchange-rate based method differs from the one mainly applied by the IMF (International Monetary Fund) and the World Bank for their estimates of world and regional economic growth, which is based on purchasing power parity (PPP) weights.

b) The World Bank classifies countries and territories whose GNI (formerly GNP; Gross National Product) per capita is $12,696 or higher as High-Income economies. Anything below that number would be considered a developing country (though World Bank prefers the terms Upper-Middle Income, Lower-Middle Income, and Low Income). (World Population Review, GNI Data: 2020)

“In 2022, 80 of the 217 countries and territories tracked by World Bank qualified as High Income, while 137 qualified as developing economies/countries.”

(World Population Review, GNI Data: 2020)

2. Socioeconomic.

A holistic rating including socioeconomic factors.

The United Nations uses various factors to determine a scale of rating subject to the overall or wholistic health and well being of the national population. These factors include infant mortality, life expectancy, education, health, quality of life and economic growth.

The highest possible HDI score is a 1.0. A country that scores less than .80 is considered developing. (World Population Review, GNI Data: 2020)

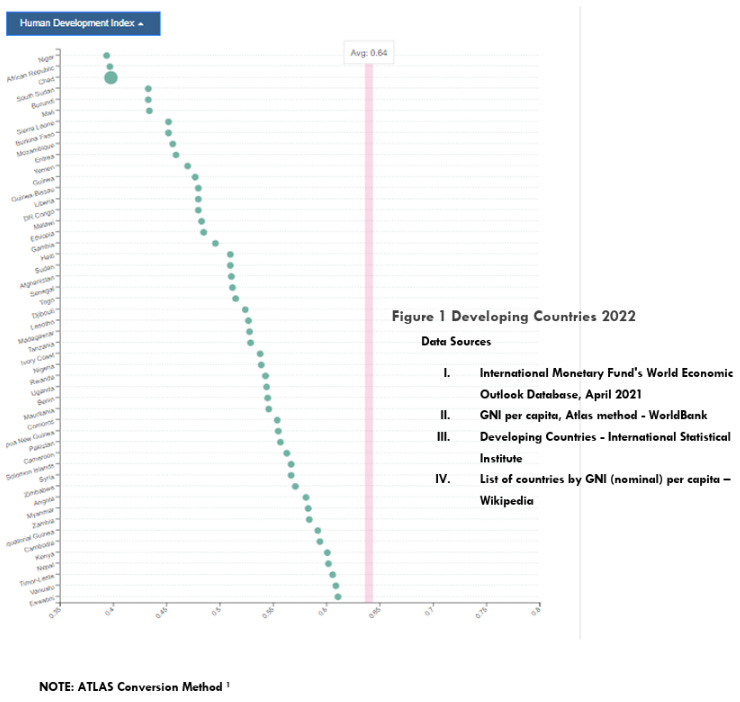

Figure 1. Developing Countries 2022

Chart: Data & Sources:

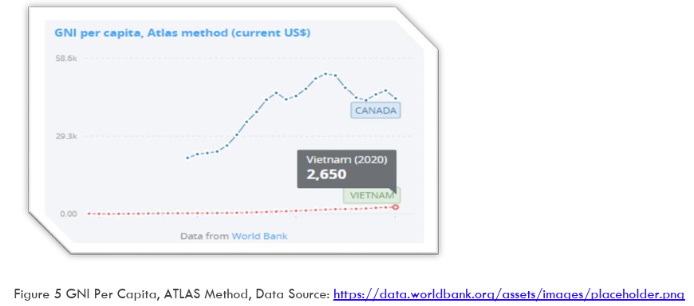

ATLAS Conversion Method

- International Monetary Fund’s World Economic Outlook Database, April 2021

- GNI per capita, Atlas method – WorldBank Developing Countries – International Statistical Institute

- List of countries by GNI (nominal) per capita – Wikipedia

Note: To smooth fluctuations in prices and exchange rates, a special Atlas method of conversion is used by the World Bank. This applies a conversion factor that averages the exchange rate for a given year and the two preceding years, adjusted for differences in rates of inflation between the country, and through 2000, the G-5 countries (France, Germany, Japan, the United Kingdom, and the United States). From 2001, these countries include the Euro area, Japan, the United Kingdom, and the United States. https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=CN-CA-BR-GB

Analysis: Part 1

Market Entry in Industrialized Nations

Interest in Canadian markets is from the manufacturing and construction sectors with an abundance of natural resources to use in production of finished goods such as raw material to supply building construction materials and inputs required for finished woodworking products like furniture.

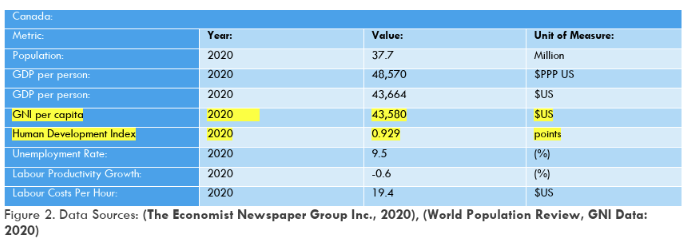

Figure 2. Data Sources: (The Economist Newspaper Group Inc., 2020), (World Population Review, GNI Data: 2020)

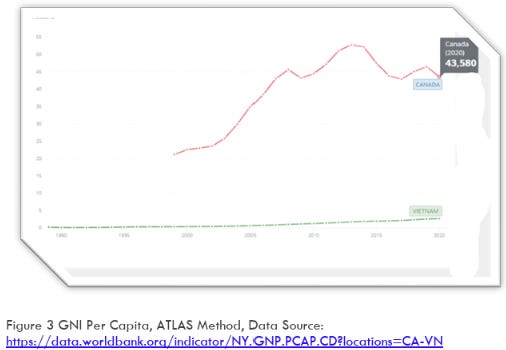

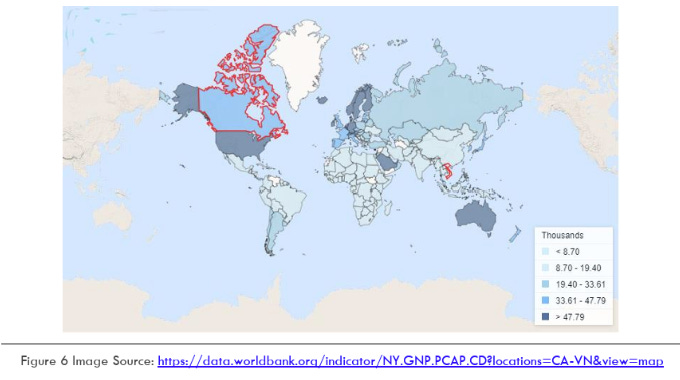

Figure 3 GNI Per Capita, ATLAS Method, Data Source: (https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=CA-VN)

Important Factors to Consider:

The best strategy would be to enter using an established method to advertise openness to trade such as participation in trade shows and establishing a physical presence for trade within the country.

For example, one significant cost associated with market entry in Canada is, as demonstrated by the data, the cost of labour.

An Example of a Successful Launch in Canada:

Global leading fashion retailer with wide product variety, discounted stores “Nordstrom Rack” and high-quality service experience a priority at the all the brands’ store locations and online e-commerce omnichannel.

Nordstrom Canada Launch, Timeline:

Analysis: Part 2

Market Entry in Developing Nations

The developing nation status for Vietnam includes recent progression towards industrialization. This can be partially attributed to next door neighbor China’s growth as a newly industrialized nation with their evolution away from low-cost, low-tech production into higher value, technically advanced, consumer goods production.

China’s departure from this category of manufacturing has created a path and opened an opportunity for other markets to emerge and to develop, including Viet Nam.

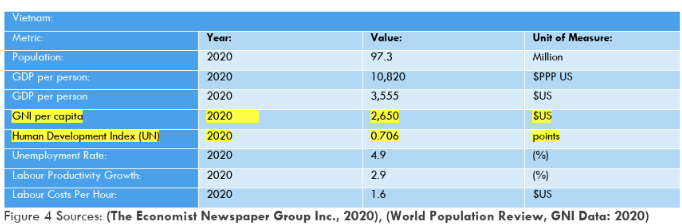

Figure 4 Sources: (The Economist Newspaper Group Inc., 2020), (World Population Review, GNI Data: 2020)

Figure 5. GNI Per Capita, ATLAS Method, Data Source: (https://data.worldbank.org/assets/images/placeholder.png)

Important Factors to Consider:

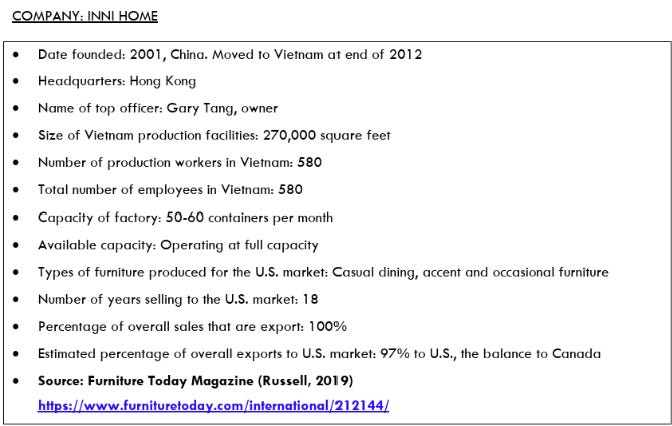

The furniture industry is Vietnams fifth largest industry, representing 5-7% of the global market. Vietnam was the first exporter of furniture to serve the massive Southeast Asian markets. Vietnam is also considered an energy producer and exporter, similar to Canada.

Issues which will need to be addressed by companies launching into Vietnamese markets include low quality, marketing challenges, low-tech or inadequate equipment, and low skilled labour. All of these factors cause these ventures to appear less unattractive to investors.

An Example of a Successful Launch in Vietnam:

Inni Home Launch, Timeline:

Figure 6. Image GNI per capita, Atlas method (current US$) – Canada, Viet NamData from the World Bank national accounts data, and OECD National Accounts data files. CC licence: (https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=CA-VN&view=map/)

Conclusion

International Markets: Differentiation and Strategy

In conclusion the international markets of each country can vary widely by the economic and social factors they experience at any given time. For evaluators, the greatest frustration could be a lack of relevant timely data to gauge the obvious changes in direction of nation states following major global disruptions and caused by pandemic conditions. These new factors, have altered the international standing of many nations over an unprecedentedly short timeline.

Covid-19 initiated political upheavals with real consequences to development which are sure to be seen in the economic, social, and humanitarian metrics applied to rating industrialized status over the near term. Quick directional reversals can be observed in NIC’s (newly developed countries) and the Russian invasion of Ukraine is an event with deep ramifications on the global stage. Recent cascading shocks include surprisingly rapid political fallout in Venezuela which brought about a sharp decline of the national currency and was immediately followed by domestic chaos.

These are indications of the hardships, political ambitions, and ongoing domestic pressures each national body experienced at the time of the viral outbreak and others will rise into the forefront of the changing global situation.

Diversified Methods and Applied Strategies.

Recommended Steps for a New Business Seeking International Market Entry:

As discussed, the way to establish best methods for a new market entry is by trying to balance risks with reward. Currently, a lack of statically accurate and timely data used to gain perspective into developing markets in a post-covid world is a real challenge. 2020 information is no longer representative of the fast adjustments that need be made in todays changing global environment.

The health experienced by the most resilient nation states in developed world was taxed mightily by the pandemic and it is yet to be seen what this will mean for countries with less robust governance, financial supports and infrastructure in place to herald the start of recovery.

On the other side of the argument is that given a stable starting point, nations who were strong in their development and had a greater socioeconomic system in place might be poised for rapid expansion and growth. This perspective is tempered with the knowledge of Venezuela’s seeming unlikely negative turn after corruption grasped onto vulnerability in the moment and blocked the course correction which would have ended in their steady progression into industrialization. This climate is volatile and by no means simple, so market entry at any juncture carries risk of trade disruptions, supply shortages and a world facing critical changes for politics and the balance power.

The world is experiencing a move towards “de-globalization”, fundamentally understanding that international trade becomes less desirable under global uncertainty. There are heavy financial pressures on governments to stop spiralling inflation and to feed a hungry population with less certainty of supply for critical commodities including meats, grains, fertilizers, and fuel.