Are You a Canadian Business with Tariff Concern’s? We’ve Included Resources to Make Things Easier for You.

What’s New:

On February 1, 2025, the U.S. announced that it was imposing tariffs goods imported into the U.S. from Canada and Mexico that started with raising tariffs on steel and Aluminum by 25% and took effect on March 4, 2025.

Chinese imports also recieved new tariffs and the “des minimus” provision which enabled small packaged items shipped en mass without taxation into the USA was blocked, dramatically altering the ability for containers full of cheaper consumer items to enter the country essentially tax free, these include items found on ecommerce websites like TEMU and SHEIN.

More tariffs promised to be levied relating to other countries are also being discussed by the President of the USA creating an uncertain atmosphere. Preparations for retalitory tariffs by other nations and quick recaculations of the globalized economy are underway while the USA takes further action to restrict imports of goods.

Canada and China have as of todays date, already announced their initial retalitory tariffs with more on the way. Mexico promising the first announcement of American imports into Mexico facing new trade restrictions via retalitory tariffs on the weekend, one week later.

The United States had agreed to delay the imposition of respective tariffs on imported goods however, the coming trade war does not offer any hope to reduce price inflation or ease the power of the US dollar in international markets. Both leading to pressures on US consumers with an immediate impact seen early on in the stock markets, as well.

Economic conditions created for free trade and increased globalization have not been as dramatically impacted since WWII and a sharp contraction in markets plus dramatic slowing of consumer spending could lead to an unprecedented recession in the west.

What Can Business Owners Do?

To survive and even thrive in these conditions, business owners must establish a level of familiarity with the trade agreements and HS Codes that apply to their upstream supply sources – in addition to their immediate customers. Many finished goods utilize globalized manufacturing practices to complete the production of components and source raw materials from other countries which could be undergoing external changes to their availability and cost due to new trade restrictions.

- Start Communicating

- Learn About Supply Chain Resilience

- Strategically Approach Supplier Selection and Diversification

- Think About Re-Shoring Business Operations

- Localization: Plan For Production

Be On The Lookout For…

Direct impacts to customer sales may remain predictable and immediate supply sources may appear largely unaffected, the upstream or downstream implications of new tariffs could have an immediate impact on unprepared business owners, as well.

Helpful Resources:

Instantly find a list of free webinars and other resources that will help you to keep current and navigate the changes in trade tariffs over the weeks when you follow us online.

(Scroll to the end of this post for a list of Trade and Tariff related resources, or connect on Linkedin and reach out to recieve specialized support from Supply Chain Logistics Consulting)

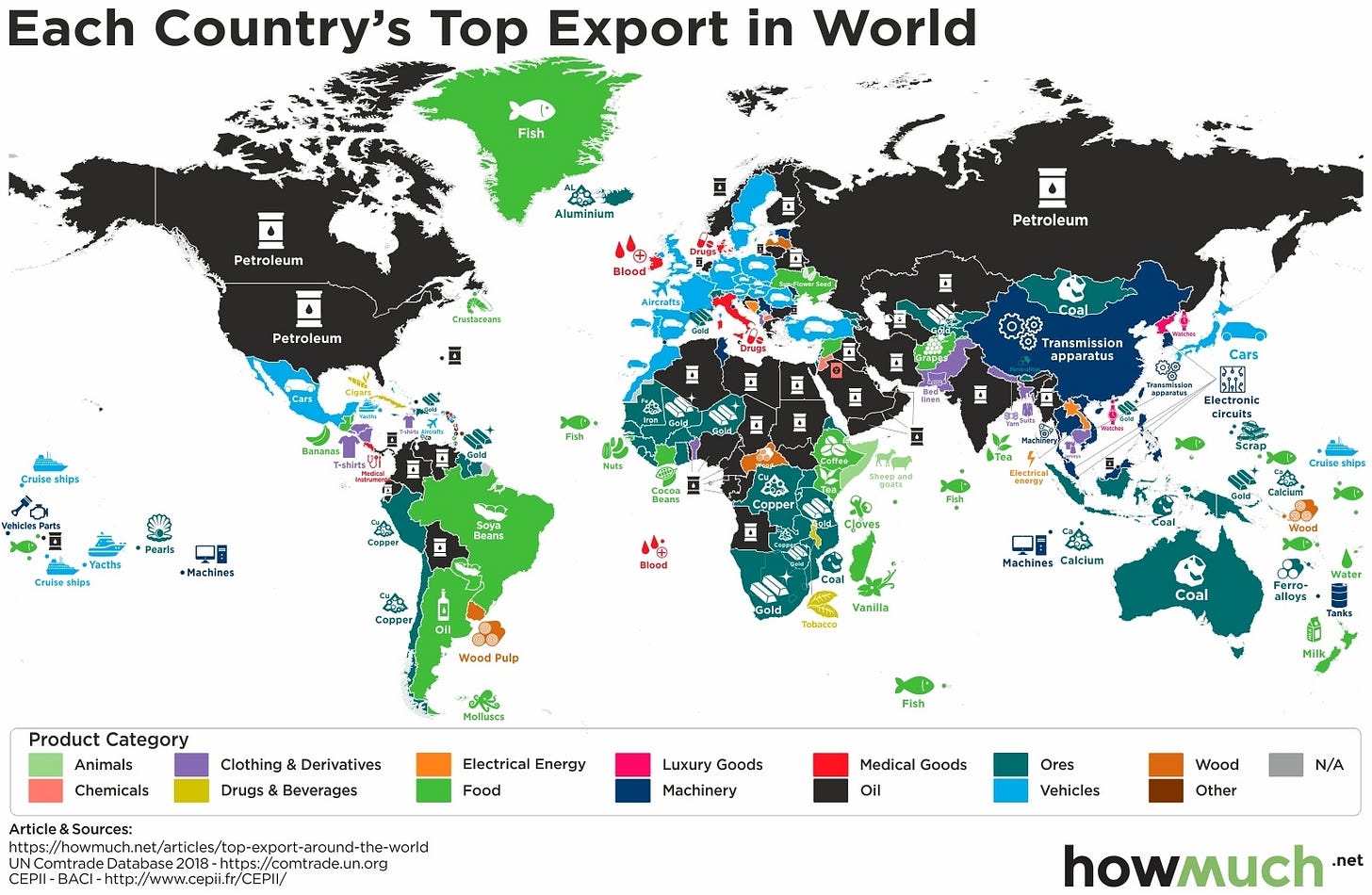

Now, Take a Visual World Tour of Top Exported Items

Maps from ”HowMuch.com”

Worldwide Top Export by Country

Observable Global Trends

Globally: Petroleum is the most common.

Europe: Manufactured finished goods.

African Countries: Extraction materials.

Asian Countries: Electronic devices.

Visualized: 🌎 Worldwide Top Export by Country

Observable Trends

🌐Globally: Petroleum is the most common

🌐Europe: Manufactured finished goods

🌐African Countries: Extraction materials

🌐Asian Countries: Electronic devices

#supplychain #globaltrade https://t.co/R0qmyU1Wa5— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

North American Countries

Canada’s top export is petroleum.

USA is both the single largest global producer and the largest consumer of oil.

Mexico is a source of manufactured vehicles.

Data from US Energy Administration

North American Countries

🇺🇸USA is both the single largest producer and the largest consumer of oil

🇲🇽Mexico is a source of manufactured vehicles

Data from US Energy Administration pic.twitter.com/JlJ7d61iqS

— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

South American Countries

Varied top exports, from agriculture to manufactured t-shirts.

Natural resources are a main export from this region.

For example; Venezuela $23.2 Billion USD in oil, Brazil $33.2 Billion USD in grains.

South American Countries

Varied top exports, from agriculture to manufactured t-shirts.

Natural resources are a main export for example

🇻🇪Venezuela $23.2B oil

🇧🇷 Brazil $33.2B grains pic.twitter.com/z7OXIFuL8M— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

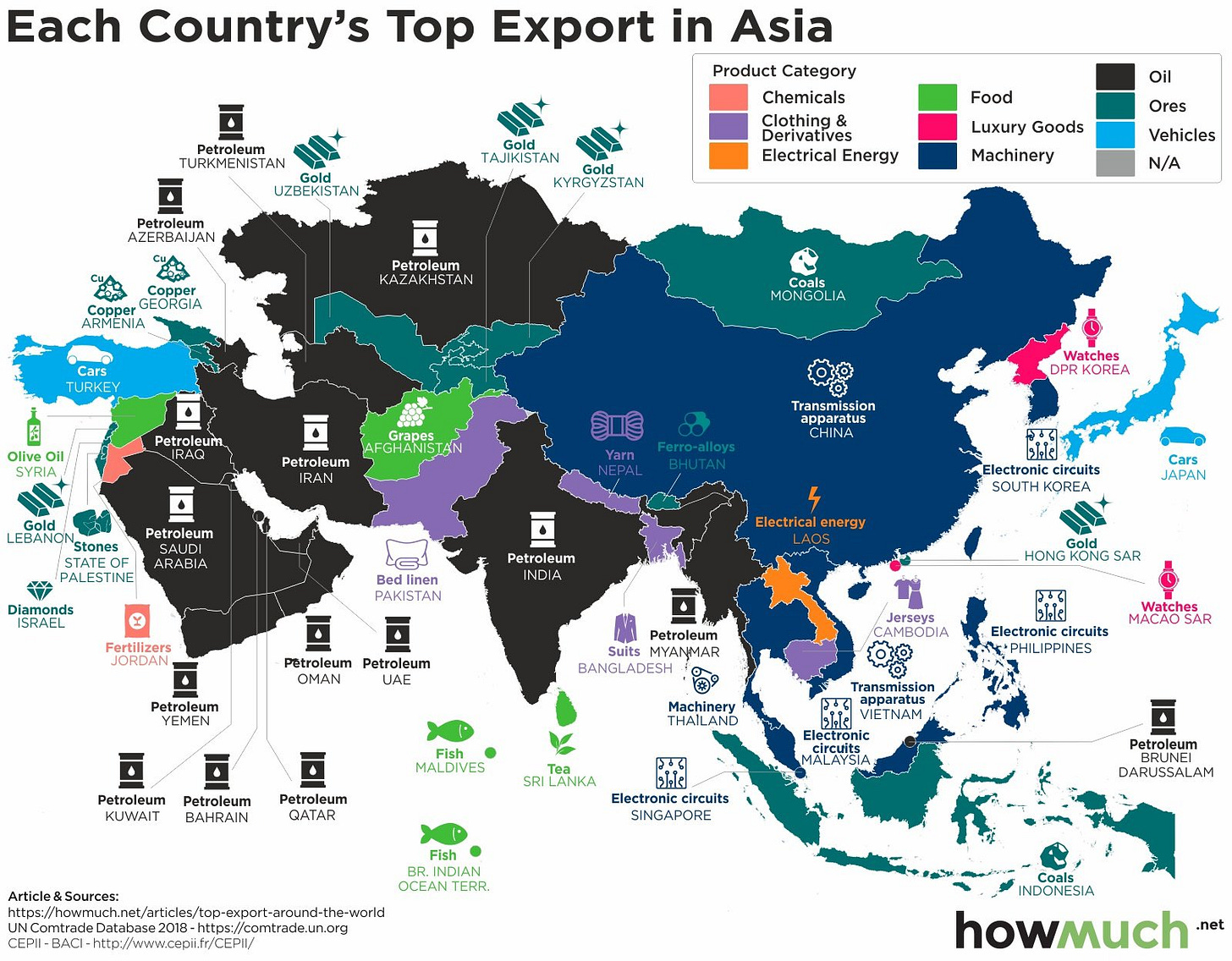

Asian Countries

China >$223 Billion USD year of electrical machinery.

Saudi Arabia’s oil averages around >$164.8 Billion /year.

India $41.5 Billion USD of petroleum annually.

Myanmar $5.6 Billion USD of petroleum annually.

Asian Countries

🇨🇳China >$223B/year of electrical machinery

🇸🇦Saudi Arabia’s oil avg around >$164.8B/year is

🇮🇳India $41.5B of petroleum annually

🇲🇲Myanmar $5.6B of petroleum annually pic.twitter.com/0wDPbXEyPV— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

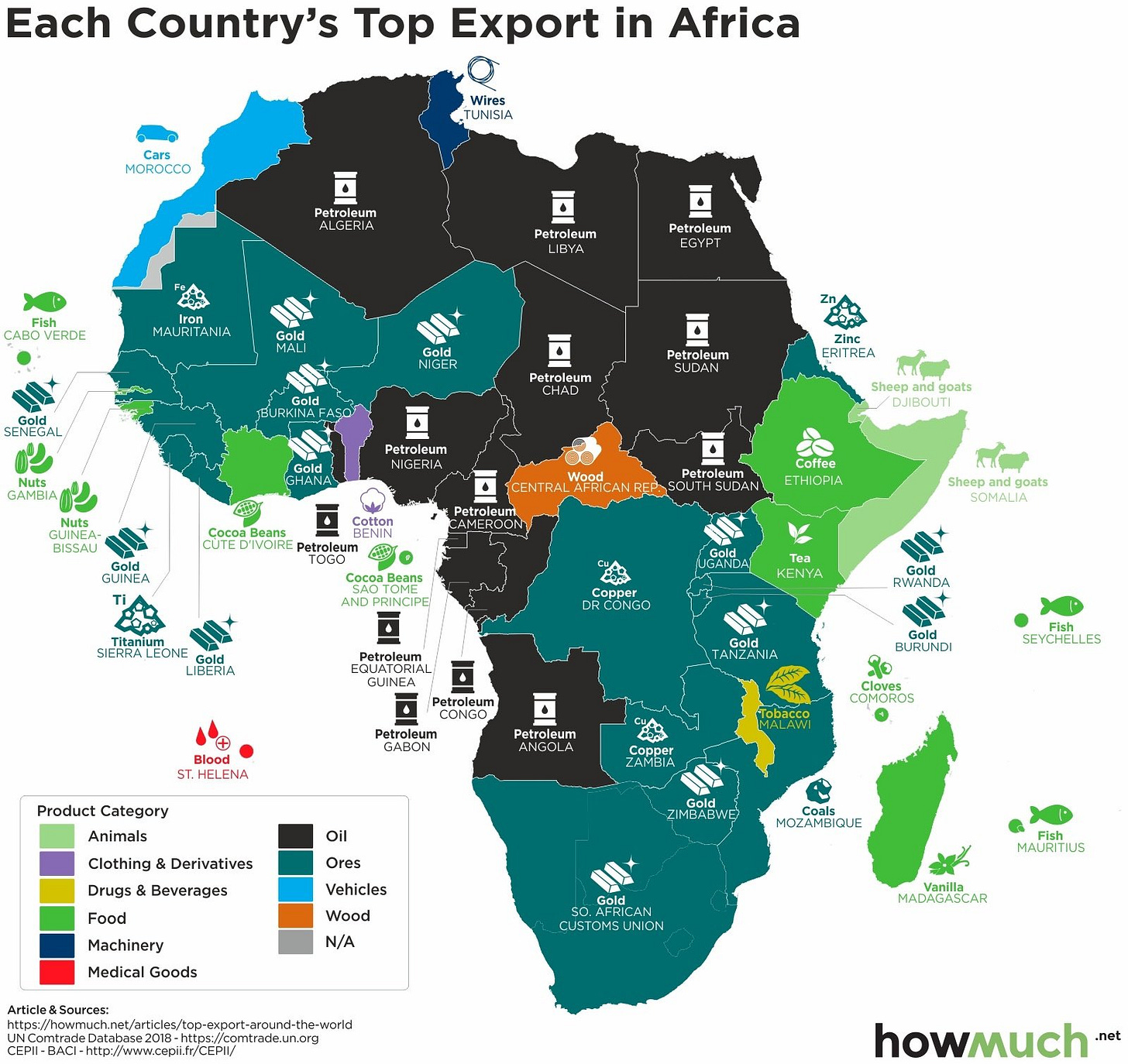

African Countries

St. Helena has the only advanced industrial export

Morocco is the only country supplying finished products (automotives)

Otherwise, African countries top exports are mostly heavy industries raw materials like petroleum, gold, cobalt, and copper.

African Countries

🇸🇭St. Helena has the only advanced industrial export

🇲🇦Morocco is the only country supplying finished products (automotives)

Otherwise, 🇿🇦🇨🇬🇳🇬African countries top exports are mostly heavy industries raw materials like petroleum, gold, cobalt, and copper. pic.twitter.com/62LEaxfJ6C— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

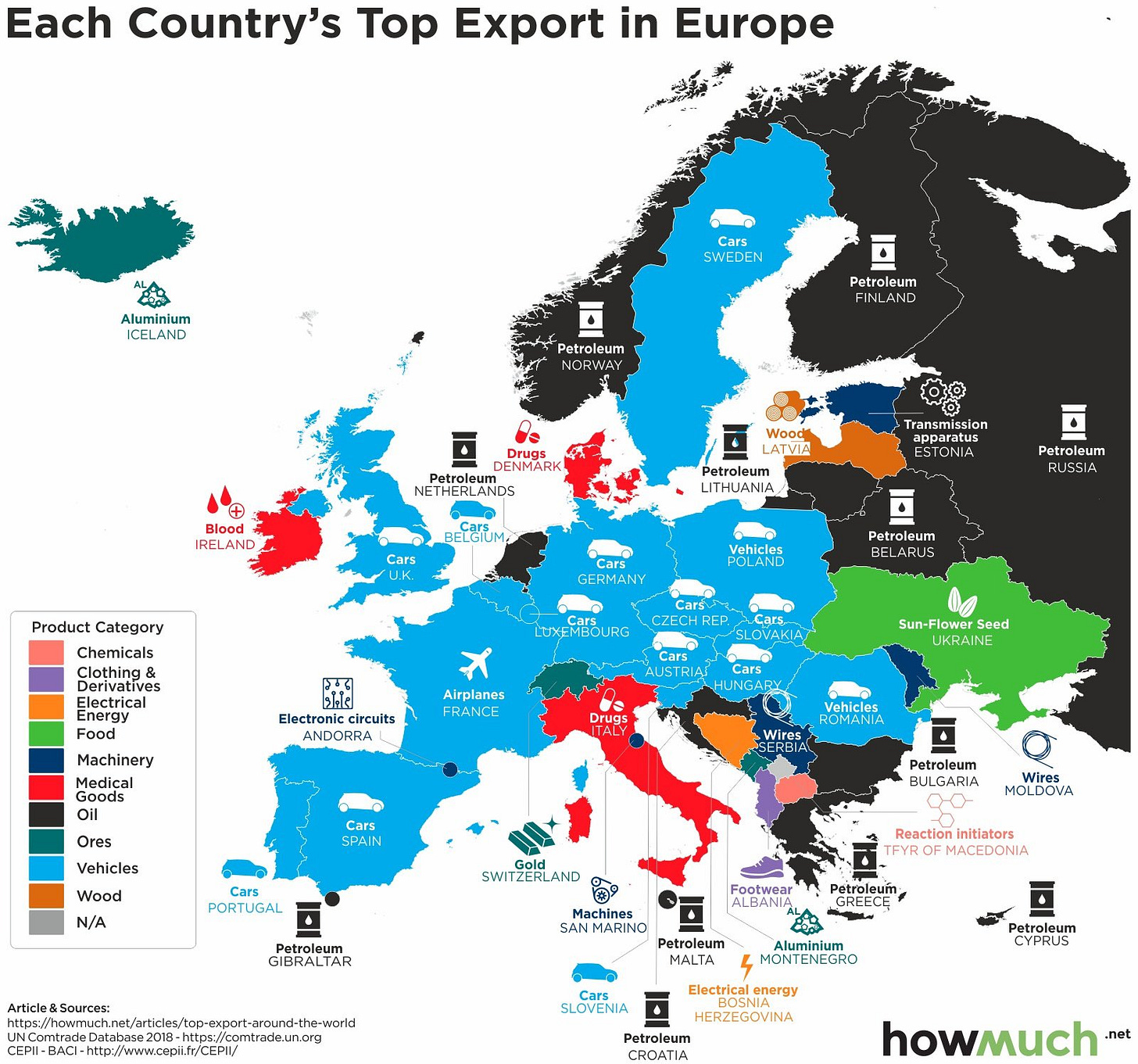

European Countries

Mostly finished manufactured products, for example…

Germany: $155.7 Billion USD yearly in vehicles.

France: 43.8 Billion USD yearly in airplanes.

UK: $43.4 Billion yearly in vehicle exports.

European Countries

Mostly finished manufactured products for example…

Germany: $155.7B/yearly in vehicles

France: 43.8B/yearly in Airplanes

UK: $43.4B/yearly in vehicle exports pic.twitter.com/NcBvmrDGza— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

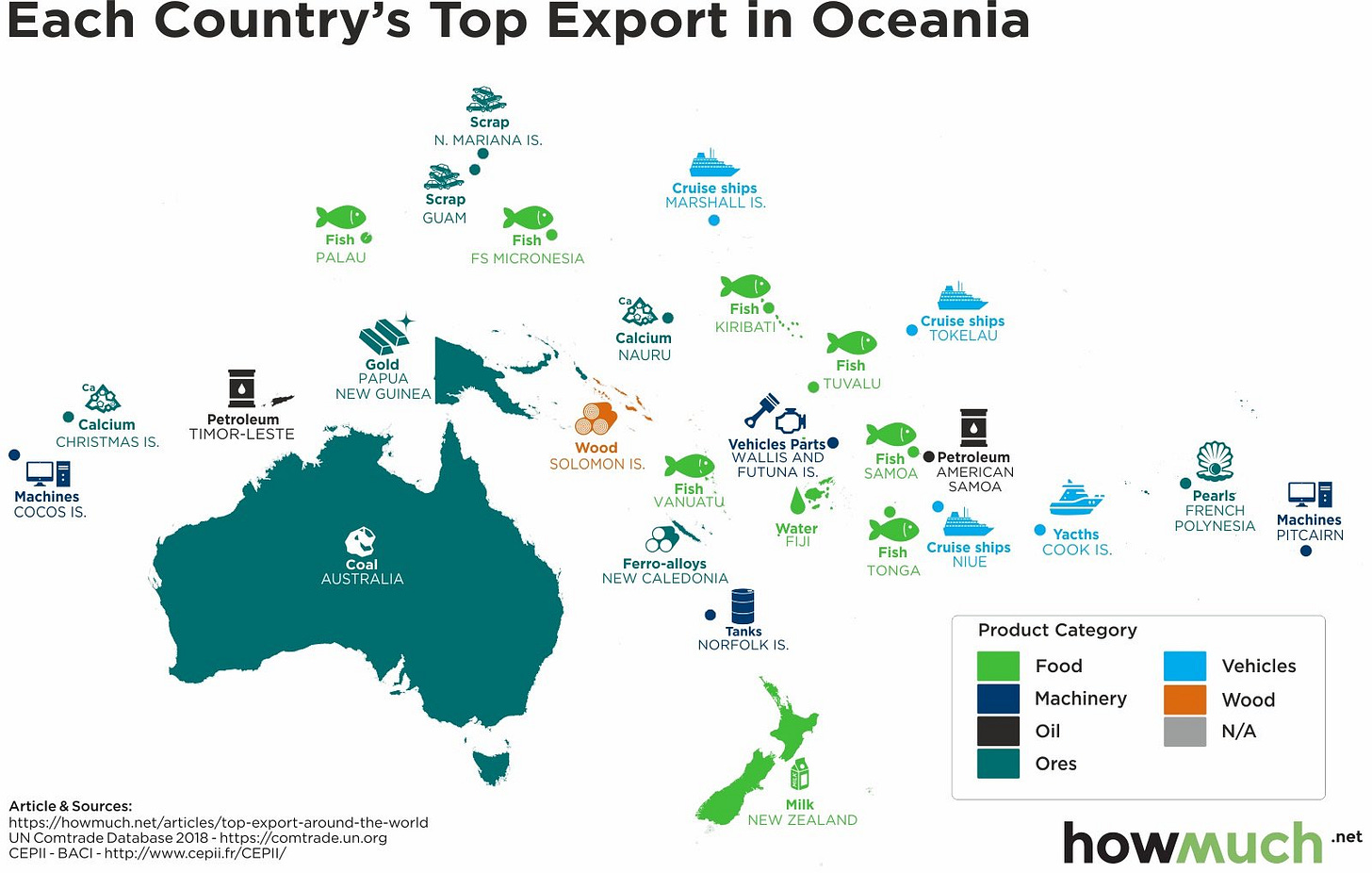

Oceanic Countries

The Island nations specialize primarily in exports from…

The fishing industry.

Manufacturing yachts and cruise ships.

Australia’s largest export is coal at $57.2 Billion USD annually.

Oceanic Countries

Island nations specialize primarily in exports of…

➡️fishing 🎣industries

➡️manufacturing yachts and cruise ships. 🛳️⚓️

🇦🇺Australia’s largest export is coal $57.2B pic.twitter.com/BkZaMBYxP0— Supply Chain Logistics Consulting (@PRO_SupplyChain) February 9, 2025

Resources:

WORLD CUSTOMS ORGANIZATION

List of HS Codes:

- Visit www.wcoomd.org to access the full list of HS codes.

BDC: Business Development Bank of Canada

“Canada Tariff Finder” Tool

Compare rates for multiple products or countries to identify your best options.

https://www.tariffinder.ca/en

More Resources to Help Business Get Ready:

https://www.bdc.ca/en/special-support/tariffs/

BDC

- Financing and advisory services for Canadian entrepreneurs

- Business Development Bank of Canada (BDC)

- 1-877-232-2269

- bdc.ca

EDC

- The international risk experts

- Export Development Canada (EDC)

- 1-800-229-0575

- edc.ca

CANADA’S TRADE COMMISSIONER SERVICE

Report: Canadian Trade Commissioner Service – “Step-by-Step Guide to Exporting.” It is an excellent source for all the technical, business, assessment and resource tools commonly used in the exporting environment.

https://www.tradecommissioner.gc.ca/guides/exporter-exportateurs/introduction.aspx?lang=eng/

Trade Commissioner Service

- Canada’s global network of trade experts

- Canadian Trade Commissioner Service

- 1-855-534-7115

- tradecommissioner.gc.ca

GLOBAL AFFAIRS CANADA

See Global Affairs Canada for more information on Canada’s free trade agreements.

https://international.canada.ca/en/global-affairs/services/trade/agreements-negotiations/investment-agreements/

GOV’T CANADA

Report: List of Products from the USA potentially subjected to a retalitory 25% tariff.

https://www.canada.ca/en/department-finance/news/2025/02/list-of-products-from-the-united-states-subject-to-25-per-cent-tariffs-effective-february-4-2025.html/

Greater Vancouver Board of Trade

GVBOT Tariff Resources Page:

https://www.boardoftrade.com/news/article/tariff-business-resources/

Greater Vancouver Board of Trade Survey for Businesses in British Columbia:

https://docs.google.com/forms/d/e/1FAIpQLScDmEo3Q-qu_G6QAblSx81RhbHL_WIU6c08g8pbgQs57H4WAw/viewform/

World Trade Conference Centre Vancouver

Business Development Programs and Resources

https://www.boardoftrade.com/training/business-development/wtc