The 4C’s for Canadian Productivity Growth. “Where Are We Now?”

In Canada…

We’re Goin’ Through Changes.

This article explores the relevance of recent observations in respect to what the latest information reveals about Canada’s recent productivity growth using data from a recent Bank of Canada report.

Earlier this year we explored information contained in a 2018 Brookings Institute report about Canada’s Advanced Industries. This report included demonstrated evidence that Canada’s advanced technology sector growth was lagging and that an improvement in performance could be achieved with certain recommended actions.

The 4 C’s are decidedly the requirements necessary for advanced sector growth and more can be found on the Brookings Institute research report recommendations here and also in Part 1 to this article by following the links below.

Review the precursor to this article titled: “Industrial Policy and Advanced Sector Growth” and subscribe to the Supply Chain Logistics Consulting website, here: https://bit.ly/3W33ELr

The Impact: Productivity in Canada

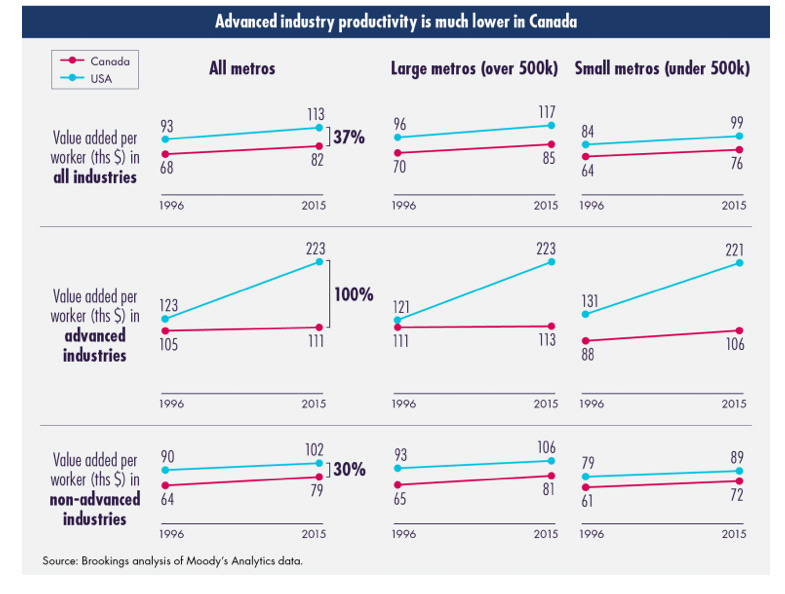

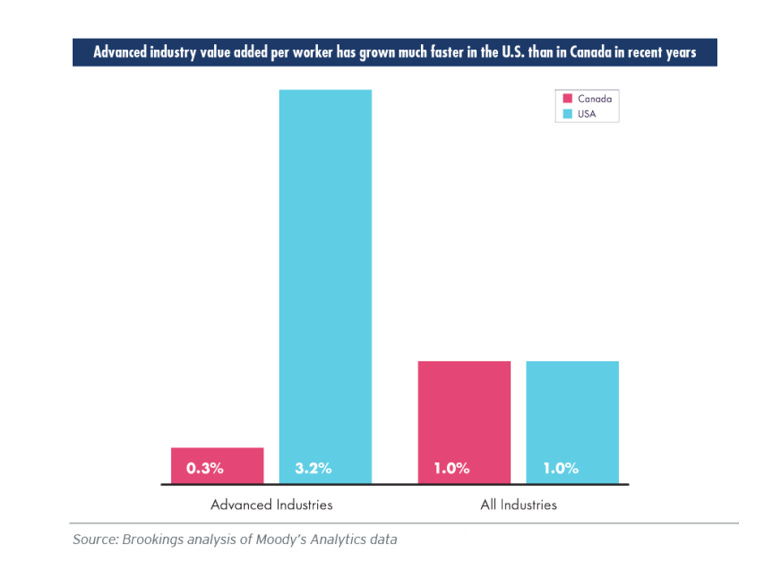

A 2018 Brookings Institute report on Canada’s Advanced Industries used data collected as late as 2015, demonstrated that the US had an unmatched acceleration and that Canada was in fact, becoming less effective in this regard.

At the time of this report and using the data collected prior to 2015, Canada’s productivity per worker had declined over time . This is most evident when the statistical data is compared with its American neighbor to the south.

The Impact: Jobs in Canada

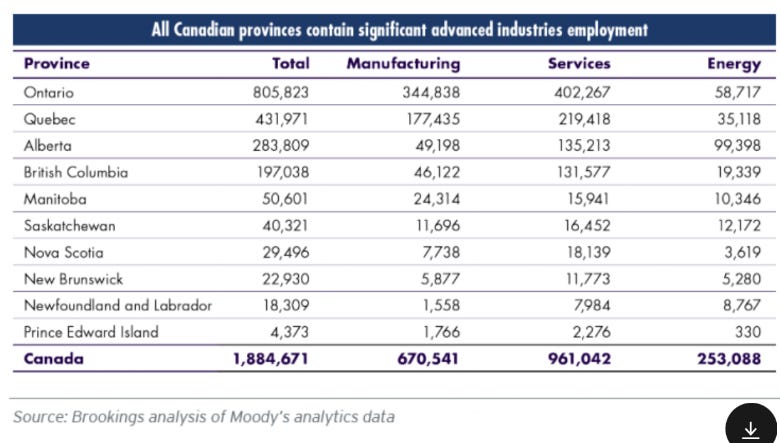

Most notably, the Brookings report highlighted that the country’s dependence on energy exports to supply a majority share of high-output, well-paying jobs requiring skilled labour were all mostly related to oil and gas extraction.

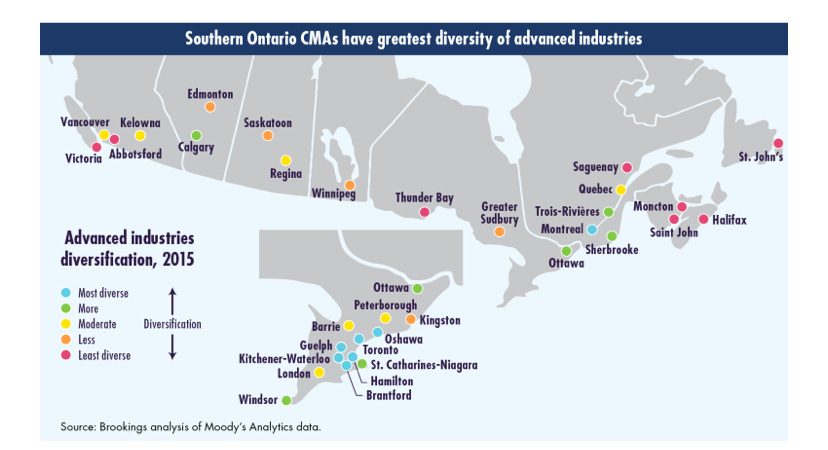

Other jobs in advanced sectors with less representation included production in automotive and aerospace, mostly located in the eastern region, whereas information technology jobs were widely spread throughout.

Canada is remarkably diverse in industry and this bodes well for the future of development in advanced technologies given the proper support and infrastructure is put into place.

www.brookings.edu/articles/canadas-advanced-industries/

Growing Canada’s Advanced Sector

The Brookings Institute report went on to suggest that the correction to Canada’s lagging productivity can be partially plotted using a framework for ‘The four C’s of productivity growth’.

“4C’s”: The 4 Requirements for Advanced Sector Growth

- Capital Deepening.

- Expanding Competition.

- Increasing Connectivity.

- Broadening Complexity.

“Canada should commit to addressing four particular sources of its deficient advanced-sector productivity growth, including issues involving the nation’s capital availability, competition levels, connectivity, and technological complexity (the four ‘C’s).”

https://www.brookings.edu/articles/canadas-advanced-industries/

The Brookings Report Recommendations:

Recommended in the ‘4C’ Commitments for Canada (summarized).

- Capital Deepening: Attract Investment in ICT, Support Growth of Canadian Venture Capital, and Supply Government Matched Funding.

- Expanding Competition: Promote Innovators Risk and Entrepreneurship with Balanced Rewards and Deregulation

- Increasing Connectivity: Make Globally Relevant and Integrated Networks using Infrastructure and Institutions.

- Broadening Complexity: Starting with Smart-Specialization supported by Data Driven Regional Investment from Federal Sources

View the Report Summary PDF: https://www.brookings.edu/wp-content/uploads/2018/06/Canada-Advanced-Industries_Summary.pdf

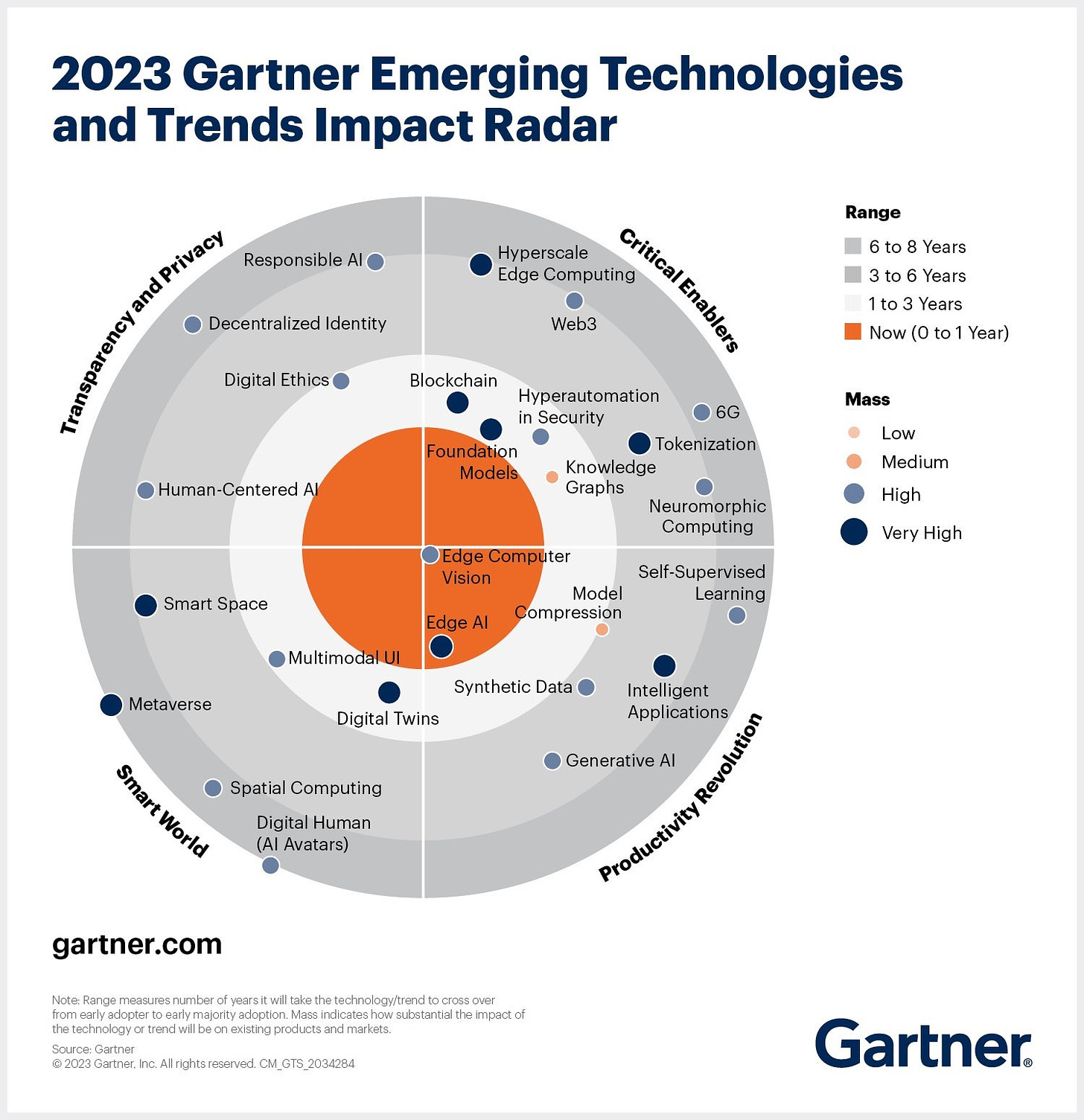

Productivity Enablers: Information Technologies

2023 Gartner Emerging Technologies and Trends

New and untested technology inevitably has a period of intense development where newer iterations become increasingly effective and robust over time. As this happens, the decrease in waste contributes to even greater affordability per unit of production and eventually mass adoption becomes possible. The new ‘normal’ of the technological advancement becomes a shared reality and the ‘old way’ is unimaginable or impossible to conceive.

Where is Canada Now?

The question remains as to whether Canada kept pace with these trends or if it has fallen further behind its North American counterparts.

Given the current incentive for innovative new technologies and rapid shift for investment in information technologies, the lagging productivity might be on the rebound from the Brookings report findings as they relate to industrial growth overall.

No picture is clear without consideration for the alternative energies from oil and gas that are gaining traction as the world seeks new ways to sustain life through a worsening climate crisis. Nevertheless, traditional energy sources remain a major component of the Canadian export profile and offsetting their negative effect with advanced technologies is most critical.

Modern electrical vehicle manufacturers made recent commitments in Canada to keep and even expand their production. In addition to an increase in the investment in EV’s and the shift to electrification of ‘everything’, research and development for artificial intelligence is taking place through many international businesses with Canadian hubs devoted to AI’s practical application.

Canada: Productivity Trends.

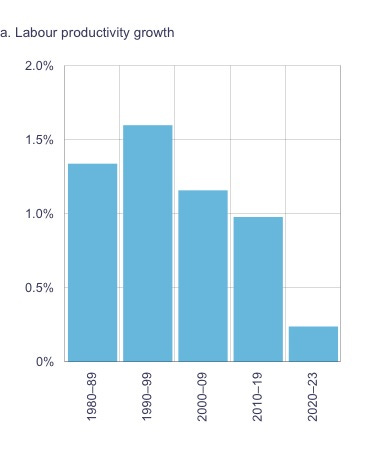

Much of the downward pressure when labour productively is isolated is attributed to the continued use of resource extraction using traditional methods and accompanied by the fact that goods manufacturing is also in decline. The expected increase from implementation of advanced technology including those from digitization, has not yet materialized.

The evolution of Canada’s advanced sectors is likely to stop short of the growth required for a complete reversal of this trend. Even greater emphasis should be placed on the four C’s for expansion of Canada’s advanced sector as summarized above and found in greater detail within the 2018 Brookings report recommendations.

By the Numbers:

Climate Policy vs Climate Risk as Factors Impacting Productivity:

It must be noted that the following segment including Bank of Canada charts did not factor in climate related risks which could alter the future for productivity growth in Canada.

The Bank of Canada classifies these disruptive impacts (climate risks) broadly as:

➡️ physical risks—chronic and acute effects from the accumulation of greenhouse gas emissions,

➡️ transition risks—changes in policies, technology and markets as economies seek to avoid physical risks by reducing emissions.

https://www.bankofcanada.ca/2024/05/staff-analytical-note-2024-12/

Climate policy and its impact is included on certain BoC report charts in the report. The report is highly recommended for further review by those interested in the potential influence of specific factors impacting future growth of productivity in Canada.

Disruptive impacts from climate change are not included as a factor impacting future growth projections in the following Bank of Canada charts.

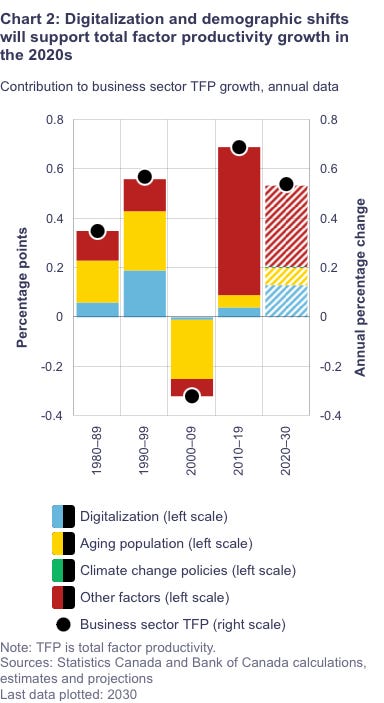

Supporting Factors for Canadian Productivity Growth:

Contributing factors expected to impact further productivity growth include continuing adoption of digitized technologies for business, the distribution and age of the population, and climate change policy.

The impact of digitization and demographic shifts are forecasted as having a supportive role on future productivity growth in Canada.

Historic Productivity Growth in Canada:

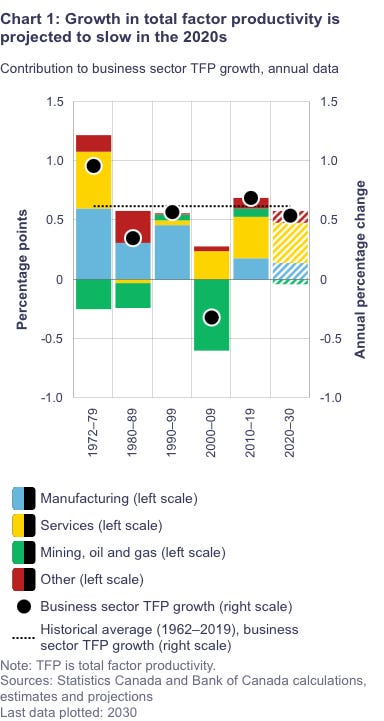

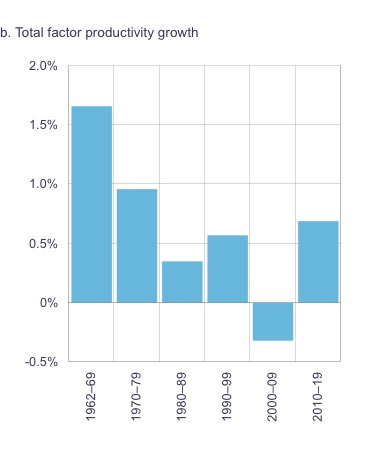

These next two charts demonstrate the historic trend towards declining productivity related to labour and post covid-19 total factor productivity increase.

Chart a) Productivity growth in the current decade by labour productivity (worker input relative to total output).

Chart b) Historic total factor productivity growth (all factors relative to total output).

The Bank of Canada remarked in a summary statement, that this data may be representative of a forecasted boom in Canadian services and historically productivity was improved with widespread adoption of technologies used for improving efficiency of industrialized agriculture.

Current total productivity growth is overwhelmingly suppressed by extraction related industries. As noted by the Bank of Canada, such sectors have not been as routinely disrupted significantly by pricing pressures and remained profitable thus leaving traditional practices dominant and labour productivity levels largely unchanged.

Forecasted Changes:

The future forecast is suppressed by the productivity expectations of industrial activity, such as extraction related manufacturing, yet has a positive outlook impacted by the upward trajectory for service delivery and manufacturing in non durable goods. This forecast demonstrates momentum towards positive productivity growth in Canada, albeit at an overall sluggish rate.

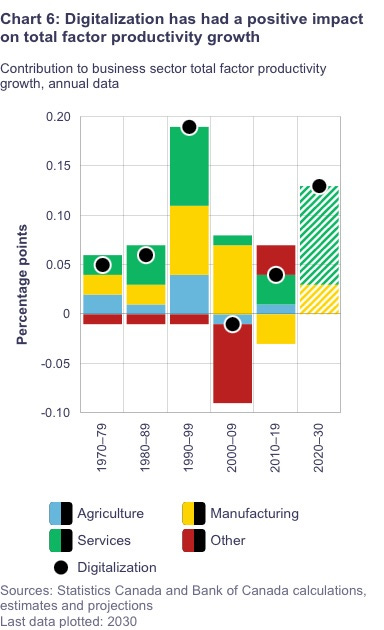

Digitization’s Future Impact on Services and Manufacturing Productivity.

A look at the forecasted trajectory of growth in Canada reveals that digitization is expected to have the most impact by increasing Canadian services and manufacturing productivity.

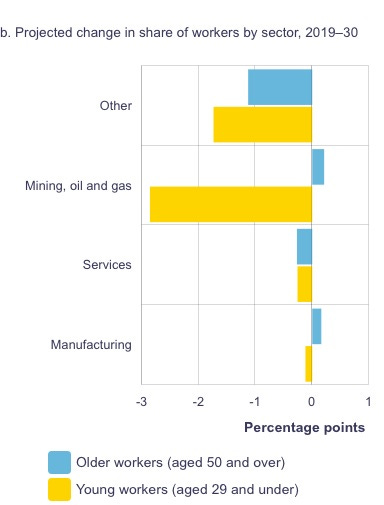

Forecasted Distribution of People Employed in Various Sectors by Age

A look at the forecasted trajectory of workers by age across industry sector in Canada using current metrics and productivity rates reveals that the change in younger (29 years of age and younger) and older workers (50 years of age and older) will change.

The percentage of older populations employed in the mining, oil and gas sector will decline while the share of younger workers is expected to increase by a lessor degree.

The manufacturing sector is also forecasted to increase its share of younger workers employed while a other sectors and the services industry decrease in number of workers from both older and younger populations.

How to Enhance Productivity Growth in Canada?

It is recommended that advanced sector development be pursued in Canada to avoid the loss of advantages that a thriving advanced sector provides. There is potential for Canada to contribute to global development and worldwide equanimity.

It is further recommended that, the advice provided by the Brookings Institute report related to specific development of the 4 Commitments be taken seriously and exploited for maximum effect.

The prospect of Canada’s taking a leading role and guiding the shape of future global development holds great promise and that bright vision could be at risk without these recommended actions.

In Conclusion

In conclusion, there is potential for Canada to attain greater stability, contribute to global development, and enhance worldwide equanimity by bolstering its ability to strengthen the advanced sector with growth and increased productivity.

Canada has a wealth of natural resources and yet very small population when compared internationally with other countries. There are reasons to remain at the forefront for advanced sector growth and development that are socioeconomic, with implications for environmental, social, and political areas.

Contributing to Global Leadership

It is assumed that adopting a global leadership approach to developing new technologies will contribute in a positive manner to national security and would therefore improve prospects for achievement of socioeconomic stability in any sovereign country, without exception. That the ability to maintain stable amid challenging circumstances will prove itself imperative to positive economic, environmental, and societal development in the future.

Greater progress improving productivity in Canada may also result in an increasingly beneficial influence within the global system. Lasting progress for positive development is best achieved with overarching objectives like universal health, individual well being, environmental stability, and widespread prosperity.

By maintaining a focus on progressive improvement and avoiding common pitfalls to innovative development Canada’s advanced sector and leadership can provide some assurance that the necessary innovative advancements to improve the lives of many will exist in the years ahead. This may also double as protection by mitigating the potential disruptions caused by inevitable exploits lacking the same holistic perspective and long-term vision.

Excerpts:

Bank of Canada Report – Analytical Notations 2024-12

The following is a direct excerpt and recommended review material. This detail is provided to assist with interpreting the charts and includes excerpts from the original Bank of Canada report found at:

https://www.bankofcanada.ca/2024/05/staff-analytical-note-2024-12/

Sectoral analysis:

We (Bank of Canada) calculate sectoral contributions to business sector TFP (Total Factor Productivity) growth by combining the impacts from all structural factors. Business sector TFP growth is projected to be lower in the 2020s compared with previous decades and the historical average. The mining, oil and gas sector is expected to be a drag on TFP and the contribution of the manufacturing sector will decline, while the services sector should provide an offset.

Before 2000, the manufacturing sector was the main contributor to TFP growth. After a difficult decade marked by the recession in the United States in 2001 and the 2008–09 recession, TFP growth resumed but at a slower pace.This slowdown reflects both a decline in average TFP growth and a lower nominal share for manufacturing industries. For instance, TFP growth in the durable goods manufacturing sector in the 2020s is expected to be one-third of its 1970–99 average, while the nominal share of non-durable goods manufacturing is expected to have decreased by 40% over the same period.

In contrast, the (Canadian) services sector has become the powerhouse of TFP growth since the 2000s… The services sector is also anticipated to continue its expansion in the 2020s; its nominal share should be about one-third higher than it was between 1970 and 1999.

The (Canadian) mining, oil and gas extraction sector has weighed on TFP growth for most decades and is expected to remain a drag in the 2020s. This decline occurred despite massive investment in the 2000s and early 2010s. One hypothesis is that given high oil prices, investments were geared toward extracting more resources rather than enhancing productivity. In contrast, the negative oil price shock of 2014 created incentives to innovate, which raised TFP growth in this sector in the late 2010s.

Climate-related risks not incorporated

Climate change could also have direct impacts on TFP, but these are highly uncertain (NGFS 2020; Bijnens et al. 2024). We thus do not incorporate the direct effects of climate change in our TFP projections and instead present risks around these projections.

We (Bank of Canada) classify these (climate risks) broadly as:

➡️ physical risks—chronic and acute effects from the accumulation of greenhouse gas emissions

➡️ transition risks—changes in policies, technology and markets as economies seek to avoid physical risks by reducing emissions

Referenced:

“Total factor productivity growth projection for Canada: A sectoral approach”

Staff Analytical Note 2024-12 (English), by Brouillette, et al., May 2024 (https://www.bankofcanada.ca/2024/05/staff-analytical-note-2024-12/)

“Canada’s Advanced Industries: A Path to Prosperity” By Mark Muro & Joseph Parilla, Metropolitan Policy Program at Brookings Greg Spencer, Martin Prosperity Institute/University of Toronto with Dieter F. Kogler and David Rigby (https://www.brookings.edu/wp-content/uploads/2018/06/Canada-Advanced-Industries_Summary.pdf)

Review the precursor to this article titled: “Industrial Policy and Advanced Sector Growth” by H.J.Schmitt SCMP at Supply Chain Logistics Consulting here: https://bit.ly/3W33ELr

If you are interested in hiring a management consultant for your business or project and want to learn more about our management consulting services, please reach out today. Supply Chain Logistics Consulting has years experience in helping people at businesses like yours to achieve results.

S&Co., Supply Chain Logistics Consulting Inc.

Visit and Subscribe on all our Channels.

- 🌐 www.supplychainlogistics.net

- 📩 Monthly Company Newsletter

- 🔗 SCLCI’s Link-in-Bio

- 𝕏 @Pro_SupplyChain

- 🔖 LinkedIn Page

… And don’t forget to share this Special Edition.